AMD EPYC 4004 and AMD Alveo Ethernet combination for High Frequency Trading

Traditional banks are undergoing major digital transformations to meet the needs of new and existing customers who seek to leverage technology for a more agile experience. From local banking institutions to big enterprises, the computing needs of the Financial Services Industry (FSI) have grown dramatically. There are four main segments in the FSI industry: Banking (e.g. Wells Fargo, Citi Bank), Payments (e.g. Visa, PayPal, Venmo), Insurance (e.g. Allianz, AIG), and Capital Markets (e.g. Fidelity, Citadel). This article focuses on Capital Markets, and in particular, High-Frequency Trading (HFT).

HFT employs high frequency CPUs and low latency network to transact a large number of orders at extremely high speeds. These platforms allow traders to execute millions of orders and scan multiple markets and exchanges in a matter of seconds. Thus, these low-latency transactions and wide visibility of data provide institutions with novel trading strategies.

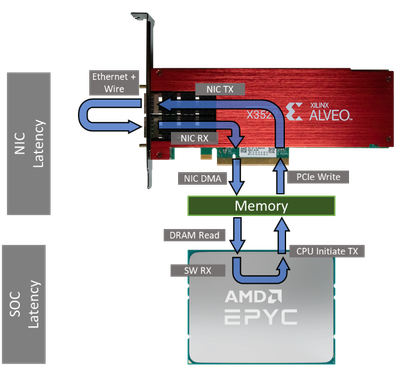

Latency in trading refers to the time delay between placing an order and its execution when trading a security. Therefore, even the slightest lag in order execution can have significant consequences. While several factors affect the latency in a system, including network connectivity and the algorithms used, a crucial component is the compute latency, which controls the time it takes to input and process the data. This latency or Round-Trip Time (RTT) is measured in nanoseconds and is composed of two elements: the latency of the Network Interface Controllers (NIC) and the system-on-a-chip (SOC) processor latency. NICs and SOCs should independently deliver the highest performance, but they also need to work together to help ensure the lowest RTT experience.

AMD EPYC™ processors with AMD Solarflare™ X3 Networking Adapter 4x 10/25G is the ideal combination for use cases that require ultra-low latency such as High Frequency Trading.

The X3 Alveo™ Ethernet Adapter has a high port density and an optimized architecture for trade execution, making it one of the lowest latency NICs in the market today. Additionally, the broad AMD portfolio includes CPUs for many use cases, including the high frequency EPYC 4004 series of server CPUs.

The EPYC 4004 series has a maximum CPU boost clock of up to 5.7 GHz and up to 16 physical cores (or 32 threads), making it one of the preferred options for HFT solutions.

The STAC-N1 Benchmark is an industry accepted benchmark test suite that characterize network technologies used in financial institutions. STAC-N1 test, using the AMD EPYC 4004 and AMD X2 NIC configurations, demonstrated that the EPYC 4004 and the AMD Xilinx XtremeScale™ X2522-25G-PLUS Adapter deliver low latencies ideal for HFT workloads. The report is available here.

In the words of Kevin Sprague, U.S. hardware lead, Optiver, “Our joint work has allowed us to expand and optimize our offering by leveraging not only AMD FPGAs, but also AMD EPYC CPUs to build out high-performance trading systems and infrastructure.”(1)

High-Frequency Trading is one of the most demanding workloads in terms of latency. However, with AMD EPYC CPUs, AMD Solarflare Ethernet Adapters and AMD Solarflare software solutions optimized for low latency, combine their capabilities to deliver one of the most efficient solutions for the FSI industry.

For more information about AMD FSI solutions, please contact AMD Support.

Rafael Colorado

EPYC Product Management and Planning

AMD

(1) Optiver Chooses AMD Enterprise Portfolio to Power its Data Center Modernization, Enabling New Er...