General Discussions

- AMD Community

- Support Forums

- General Discussions

- Re: Rumored ASIC Cryptocurrency Miners Could Be We...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rumored ASIC Cryptocurrency Miners Could Be Welcome Relief for the GPU Market

" Both AMD and Nvidia have been enjoying rosy predictions and uplifted earnings from cryptocurrency mining, but financial analysts are afraid things could be turning south. Christopher Rolland, an analyst with Susquehanna, released a note today stating “We confirm a Bitmain Ethereum ASIC.” Supposedly 20 percent of AMD’s cryptocurrency sales and 10 percent of Nvidia’s sales are to Ethereum miners. Rolland cut his target stock price for AMD to $7.50 from $13 and Nvidia’s target to $200, from $215.

There are several ways to interpret this. On the one hand, any cooling off of the cryptocurrency market would be great for gamers, who have generally been stuck paying far more for GPUs than they otherwise would — foregoing upgrades, buying new systems, snapping up used cards, or employing other various workarounds. If the GPU market begins cooling off, people can start buying video cards again — and that’s nothing but upside as far as we’re concerned.

As for the overall impact on AMD’s stock price, or the larger question of how much this should hit the company’s valuation, we don’t think most financial analysts are reading the situation very well. AMD has been clear, at multiple points, that cryptocurrency sales aren’t something it’s building itself around. The company is perfectly happy to sell GPUs to people who want to use them, including miners, but it’s not exactly basing its entire business strategy on them. AMD’s primary goals are to continue executing on Ryzen and Epyc, introduce new product models, and transition its designs to 7nm. In GPUs, it’s talking about mobile Vega hardware and a machine learning chip that’s expected to debut later this year as an early design on GF’s 7nm process."

" Now, AMD’s revenue (and Nvidia’s) have undoubtedly benefited from cryptocurrency sales, because being able to sell every GPU you can make has some real benefits. But think about what AMD (or probably Nvidia) isn’t getting out of this scenario: It isn’t getting cards into the gamer market, which is where its primary focus is. It isn’t earning more money, because GPU prices are set by contract and AMD can’t just double its asking price because its hardware is in demand. It isn’t necessarily getting more fab space at TSMC, because 14nm fab lines are also in demand, and it takes time to negotiate more production. And since the last thing AMD wants to do is be stuck with a bunch of GPUs it can’t sell, the company would undoubtedly be conservative when it comes to reserving future fab lines.

All of that said: I’m certain AMD has made money in the cryptocurrency market that it wouldn’t have made otherwise. I’m just not sure it represents some critical earning potential whose reduction or disappearance warrant cutting the company’s estimated stock price in half. I’ll be the first person to admit I’m not a financial analyst, but as a matter of technology and AMD’s own historic earnings reports, Ryzen, the PlayStation Pro, Xbox One X, and its mainstream GPU business have all historically been far more important to AMD than the vagaries of the cryptocurrency market. I don’t see the end of that market as problematic for AMD (or for Nvidia, for that matter). Neither company has bet on it, and both treat it as largely incidental to their primary goals. They may be happy to make some extra money off the windfall, but you don’t see either firm throwing it all in on cryptocurrencies. I doubt you ever will.

Best case scenario? GPU prices start approaching something like sanity in the months ahead. Worse-case? The rumor proves false and the status quo continues."

Article > Rumored ASIC Cryptocurrency Miners Could Be Welcome Relief for the GPU Market - ExtremeTech

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nah, best case scenario is Bitcoin continues to plummet, some financial institutions and governments lose millions, and laws are passed prohibiting the "manufacture" and trading of unregulated "cryptocurrency".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Great article, thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

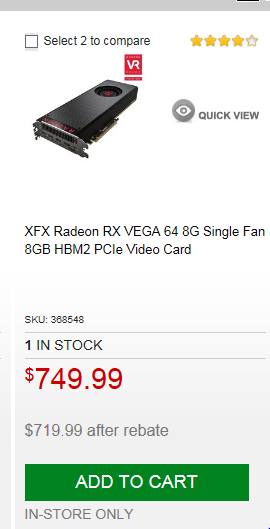

GPU prices have already been on a slow downward slope from peak over the last month.

All the miners who bought GPUs at $1000 a pop probably won't even have made back their initial investment in hardware before the ASIC launches and obsoletes their setup. Then, to try and recoup some of that capital will see all the used boards flood EBay.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bitmain announces 180 MH/s $800 Ether ASIC not a rumor anymore. One wonders though if cryptocurrency is on the downhill slide considering all the regulations and stances which are being taken against it. Will be nice seeing GPUs back to normal levels, although they have a very long way to go, especially on the AMD side.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Then Monero forks, makes gpu mining good for the time being, making asics useless, prices and profits go back up..